az auto sales tax

The Arizona sales tax rate is currently. Give us a call or stop in and get behind a new.

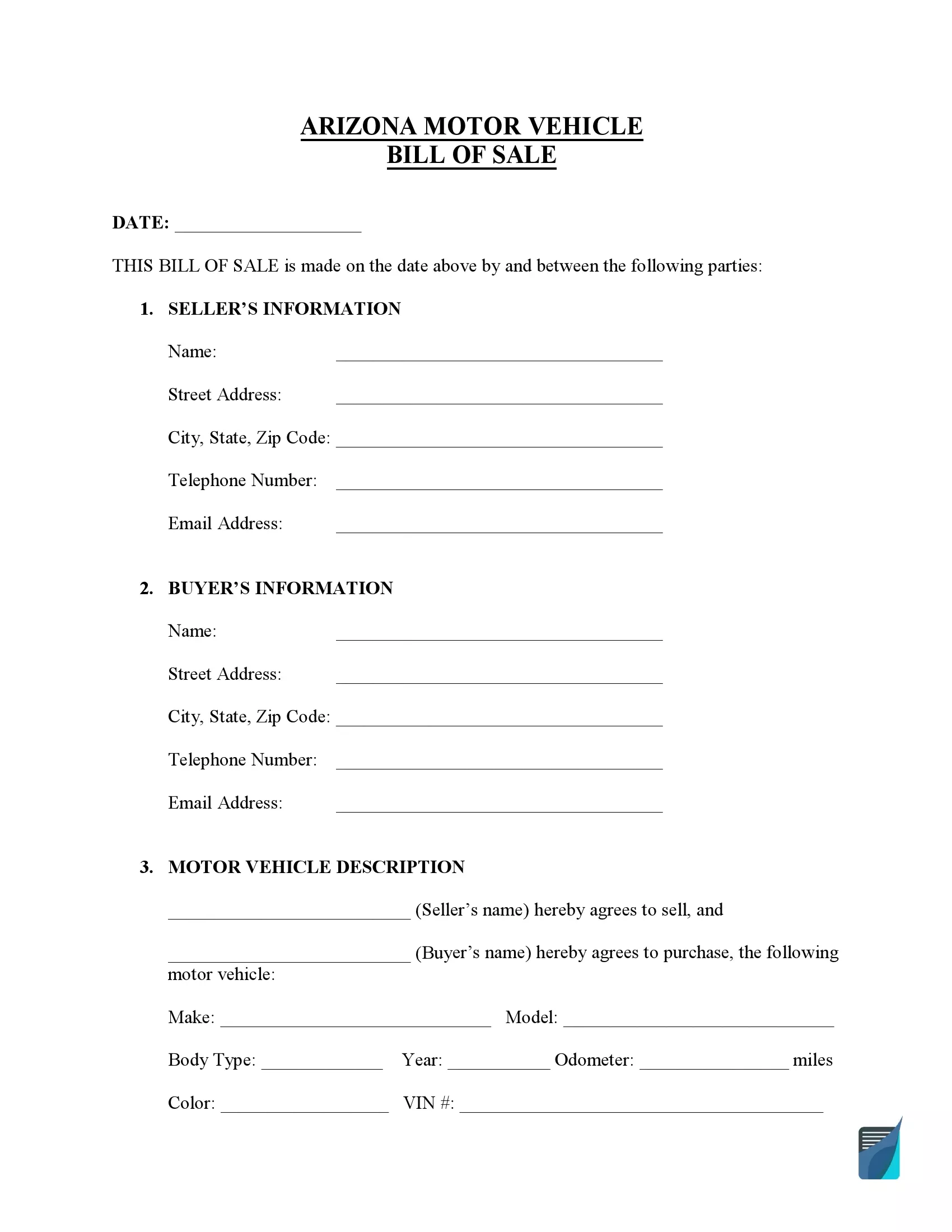

Free Arizona Vehicle Bill Of Sale Form Pdf Formspal

The minimum combined 2022 sales tax rate for Phoenix Arizona is.

. For example imagine you are purchasing a vehicle for 45000 with the state sales tax of 56. Rates include state county and city taxes. Price of Accessories Additions Trade-In Value.

November 9 2017. Register with the State of Arizona. Note that the value of your vehicle is calculated as 60 of the original manufacturers retail price and that total will be lowered by 1625 at every registration renewal.

All used and new car purchases in Arizona have the statewide sales tax of 56 applied to them. This Arizona TPT exemption prevents the nonresident purchaser from having to pay tax in both states. Glendale City Hall 5850 W.

If youre a Pinal County resident youre paying the highest sales tax. Step 1- Know Specific Tax Laws. The County sales tax rate is.

This will give you the sales tax you should expect to pay. 303 rows 2022 List of Arizona Local Sales Tax Rates. State of Arizona Vehicle Use Tax Calculator Toggle navigation.

State lawmakers are weighing a proposal by the Arizona Automobile Dealers Association to require anyone who sells a used car or truck to collect the states 56 percent sales tax the same as. The 2018 United States Supreme Court decision in South Dakota v. The Arizona VLT is calculated from the base retail price of the vehicle and the year it was first.

Zip Code Vehicle purchased out of country. Working with the Arizona Department of Revenue the Arizona Department of Transportation Motor Vehicle Division is now able to accept these payments when the buyer registers his or her vehicle at an MVD or. The Phoenix sales tax rate is.

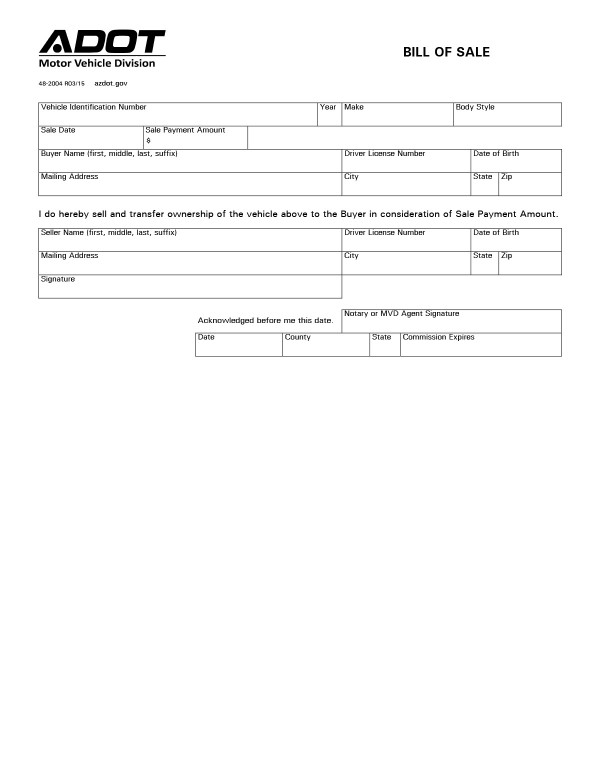

Give the title to the buyer with any lien. Main St Suite 450 Mesa AZ 85201. Sign off the back of the title and have your signature notarized.

Wayfair Inc affect Arizona. PHOENIX Arizona residents who buy cars out of state now have a much easier way to pay the city and state use taxes. County or local sales tax is specific to each area within Arizona and thats tacked on in addition to the statewide rate.

This tax is assessed for each 100 of your vehicles value. Ad New State Sales Tax Registration. 42-5061 A 28 a provides an exemption from state TPT and county excise tax for sales of motor vehicles to nonresidents from states that do not provide a credit for taxes paid in Arizona.

This is the total of state county and city sales tax rates. Complete a sold notice on AZ MVD Now. Some cities can charge up to 25 on top of that.

Did South Dakota v. Buyers Address Vehicle Domicile Address. Content updated daily for arizona sales tax on cars.

In Arizona the sales tax for cars is 56 but some counties charge an additional 07. Vehicle Use Tax Calculator. In addition to taxes car purchases in Arizona may be subject to other fees like registration title.

County tax can be as high as 07 and city tax can be up to 25. City Hall Offices are open Monday - Friday from 730 am. M-Th 7 am - 6 pm.

Auto Sales Tax information registration support. The other taxes specific to Arizona are the Title tax of 4 the Plate Transfer tax of 12 and the Registration tax of between 8 and 120. However the total tax may be higher depending on the county and city the vehicle is purchased in.

When a vehicle is sold or otherwise transferred you the seller are required to. Box 1466 MS1170 Mesa Arizona 85211-1466. Tax Paid Out of.

There are a total of 80 local tax jurisdictions across the state. Unfortunately the price isnt capped there. Remove the license plate from the vehicle and contact MVD to transfer it to another vehicle you own or destroy it.

Sales Tax Rate Chart. 2020 rates included for use while preparing your income tax deduction. Arizona collects a 66 state sales tax rate on the purchase of all vehicles.

Multiply the vehicle price after trade-in andor incentives by the sales tax fee. For example if your budget for your next car is 15000 and you make your purchase in Apache County you would pay about 915 in sales tax 15000 x 061. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience.

This exemption and the documentation. The December 2020 total local sales tax rate was also 8600. ARIZONA DEPARTMENT OF REVENUE.

For more information on vehicle use tax andor how to use the calculator click on the links below. Average Sales Tax With Local. Lowest sales tax 56 Highest sales tax 111 Arizona Sales Tax.

How to Calculate Arizona Sales Tax on a Car. The state of Arizona charges a vehicle license tax VLT at every registration and renewal. The minimum is 56.

The Arizona VLT Vehicle License Tax is the major fee among others that you have to pay every 1 to 2 years when you register your gasolinediesel vehicle at the Arizona Division of Motor Vehicles officewebsite or an Authorized Third Party office. Phoenix AZ Sales Tax Rate. Phoenix AZ 85027 602 540-2251 OPEN TODAY.

Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53. The current total local sales tax rate in Phoenix AZ is 8600. Ad Looking for arizona sales tax on cars.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. The latest sales tax rates for cities in Arizona AZ state.

2021 Arizona Car Sales Tax Calculator Valley Chevy

Car Tax By State Usa Manual Car Sales Tax Calculator

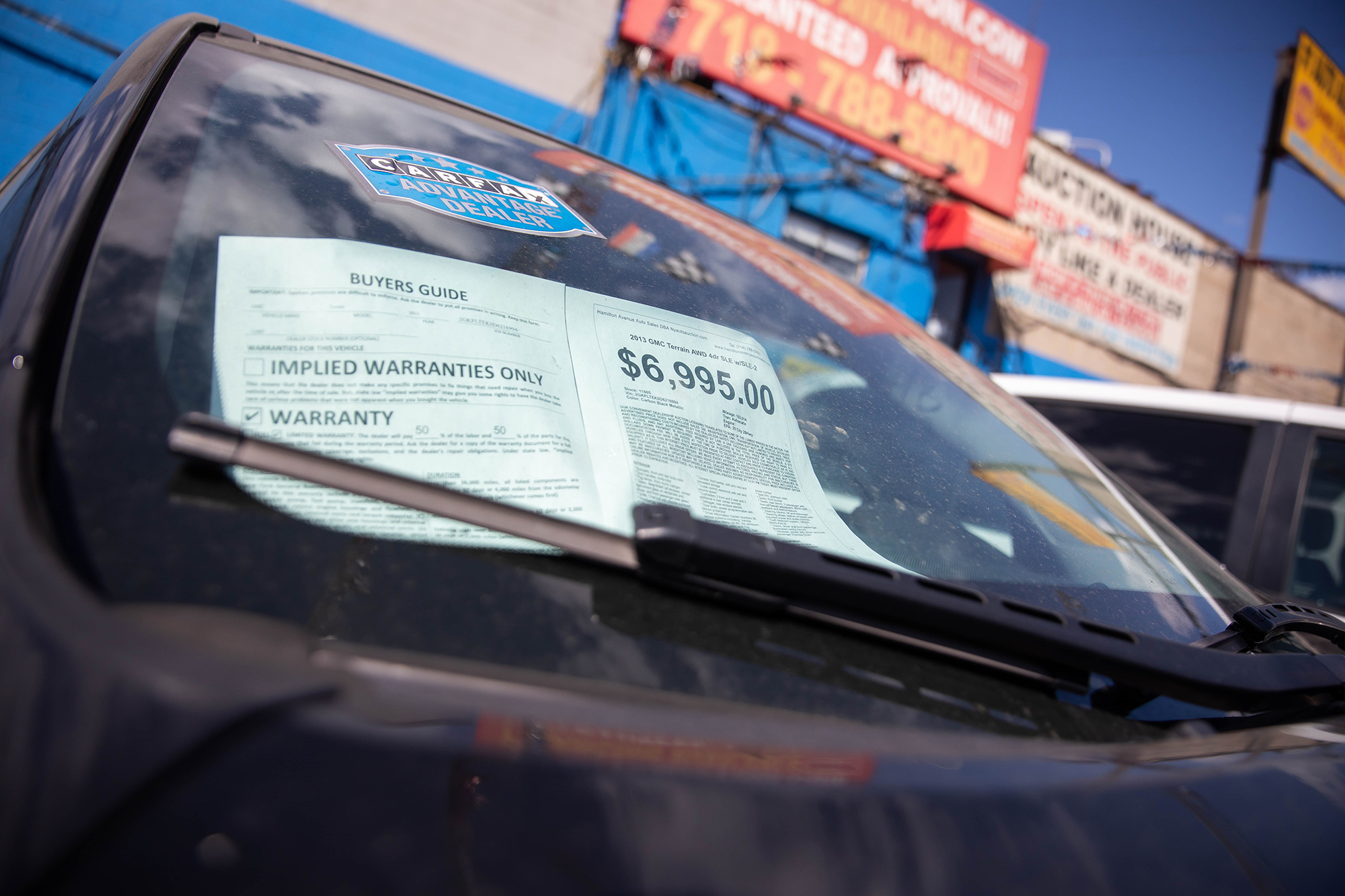

How To Sue A Car Dealer For Misrepresentation Findlaw

Here S Why Car Prices Have Gotten So High So Fast And Why They Ll Keep Climbing Cnn Business

Calculate Loan Payments Arizona Car Sales

How To Register A Car In Arizona Metromile

Nexus Program Tpt Arizona Department Of Revenue

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Arizona Sales Tax Small Business Guide Truic

Nj Car Sales Tax Everything You Need To Know

Your Top Vehicle Registration Questions And The Answers Adot

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

States With Highest And Lowest Sales Tax Rates

Arizona Bill Of Sale Forms And Requirements For Registration

How Much Are Tax Title And License Fees In Arizona Mercedes Benz Of Gilbert