tax break refund calculator

Wages from a job interest earned Social Security benefits and so on. The combined tax rate is 153.

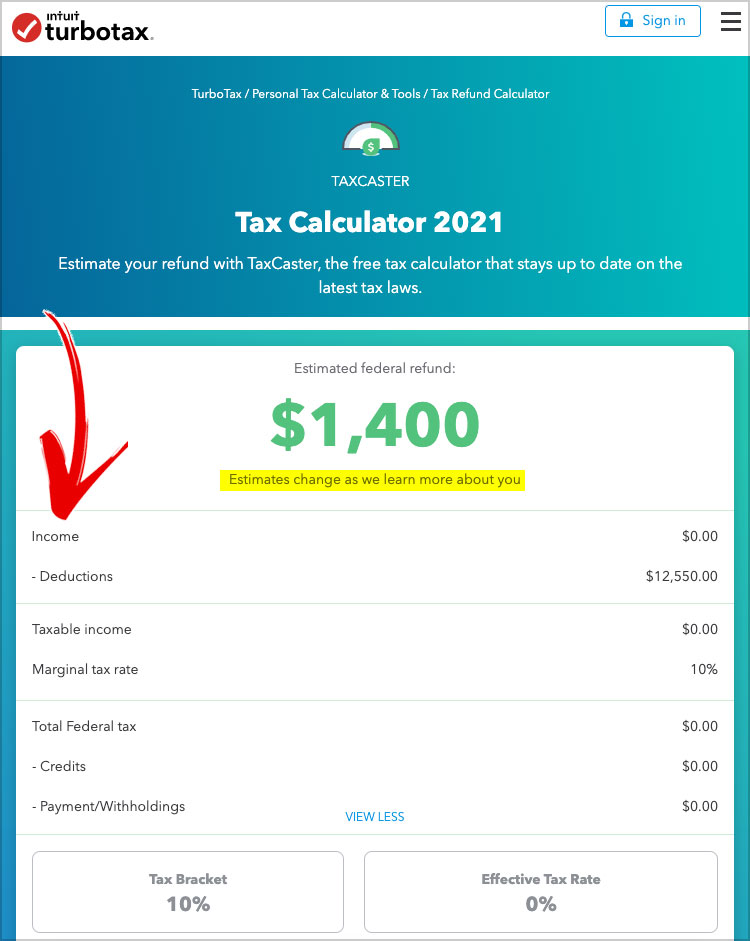

1 Free Tax Refund Estimator In 2022 Turbotax Taxcaster

Free Federal Tax Calculator.

. 17 Aug 2021 QC 16608. Based on your projected tax withholding for the year we then show you your refund or the amount you may owe the IRS. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Rest assured that our calculations are up to date with 2021 tax brackets and all tax law changes to give you the most accurate estimate. It will take between 2 and 10 minutes to use this calculator. Enter your information for the year and let us do the rest.

Simply select your tax filing status and enter a few other details to estimate your total taxes. And is based on the tax brackets of 2021 and 2022. This handy online tax refund calculator provides a.

This way you can report the correct amounts received and avoid potential delays to. Use our simple 2021 income tax calculator for an idea of what your return will look like this year. This calculator helps you to calculate the tax you owe on your taxable income.

Please be mindful that our tax calculations are only estimates. Our office locator will help you locate your nearest office and you can book an appointment online. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break.

It is mainly intended for residents of the US. Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe. These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are determined.

The HR Block tax calculator 2022 is available online for free to estimate your tax refund. Heres what you need to know. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

For tax purposes whether a person is classified as married is based on the last day of the tax year which. Additionally health and education cess at 4 are levied on the total tax rate above the total amount payable. Australian TAX RETURN and TAX REFUND CALCULATOR.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. This tax return and refund estimator is currently based on 2021 tax year tax tables. Moving on to another example weve a person and they are single.

As a 1099 earner youll have to deal with self-employment tax which is basically just how you pay FICA taxes. Given that this tool comes in handy we wanted to break down the HR Block Tax Calculators process and provide a little education on how the HR Block Tax Calculator works. It makes sense to choose whichever will yield you the greatest tax break but if you choose to itemize deductions youll need to keep track of your expenses and have receipts.

Youll get a rough estimate of how much youll get back or what youll owe. Then find out how you can slash your taxes. Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process Sipp Tax Relief Calculator Tax Relief On Pension Contributions Top 5 Tax Return Estimators 100 Free Free Tax Help Income Tax Calculators And Tax Guides Taxbanana Com.

Tax break refund calculator Saturday June 4 2022 Edit. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent. Meet with a Tax Expert to discuss and file your return in person.

Lets say they were on unemployment last year which means their income is somewhere between 9800 to 40000. To find out what your final tax return summary will look like call 13 23 25 and let our tax accountants walk you through the tax refund process with ease. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Normally the 153 rate is split half-and-half between employers and employees. Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States.

Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe the IRS when you file taxes in 2021. So doing a little calculation gives us the following. Bidens legislation changes the rules for this year to ensure individual taxpayers who received federal unemployment benefits wont have to pay tax on the first 10200 they received while couples filing jointly will be exempt from paying taxes on 20400 of benefits.

Tax Refund Calculator. This is the refund amount they should receive. Paying taxes as a 1099 worker.

It is mainly intended for residents of the US. CALCULATE YOUR REFUND NOW. It can be used for the 201314 to 202021 income years.

Instantly work out your estimated tax return refund. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file.

The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. If youve yet to file your taxes you wont be getting a refund but your. You can also use our free income tax calculator to figure out your total tax liability.

Stop by an office to drop off your documents with a Tax Expert. Enter your filing status income deductions and credits into the income tax calculator below and we will estimate your total taxes for. This link opens in a new window.

This calculator is for 2022 Tax Returns due in 2023. Using these calculators should provide a close estimate of your expected refund or liability but it may vary a bit from what you ultimately pay or receive. Find out if youll get a tax refund.

Simply enter your numbers and our tax calculator will do the maths for you. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your. Start with a free eFile account and file federal and state taxes online by April 18 2022.

Effective tax rate 150. Tax breaks that directly reduce your tax obligation. File your taxes the way you want.

10200 x 022 2244.

How To Calculate Your Federal Income Tax Refund Tax Rates Org

Tax Refund Calculator 2020 2021 Tax Return Estimator Industry Super

What Are Marriage Penalties And Bonuses Tax Policy Center

See Your Refund Before Filing With A Tax Refund Estimator

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Tax Return Calculator 2012 Tax Calculator 2012

Rrsp Refund Tricks And Traps Physician Finance Canada

Online Australian Tax Return And Refund Calculator

How To Estimate Your Tax Refund Lovetoknow

Donation Tax Calculator Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine

Tax Refund Tips You Should Know About Tax Refund Tax Help Making A Budget

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Calculator Estimate Your Income Tax For 2022 Free

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

Tax Return Calculator Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive Parts